Hawaii

How to Form an LLC in Hawaii

Starting a business in Hawaii is easier than many people expect. The Hawaii Department of Commerce and Consumer Affairs (DCCA) offers a smooth online filing system, making it simple to register a Hawaii LLC whether you live in the islands or operate from another state.

Here’s a complete step-by-step guide on how to form an LLC in Hawaii correctly.

Step-by-Step Guide: How to Start an LLC in Hawaii

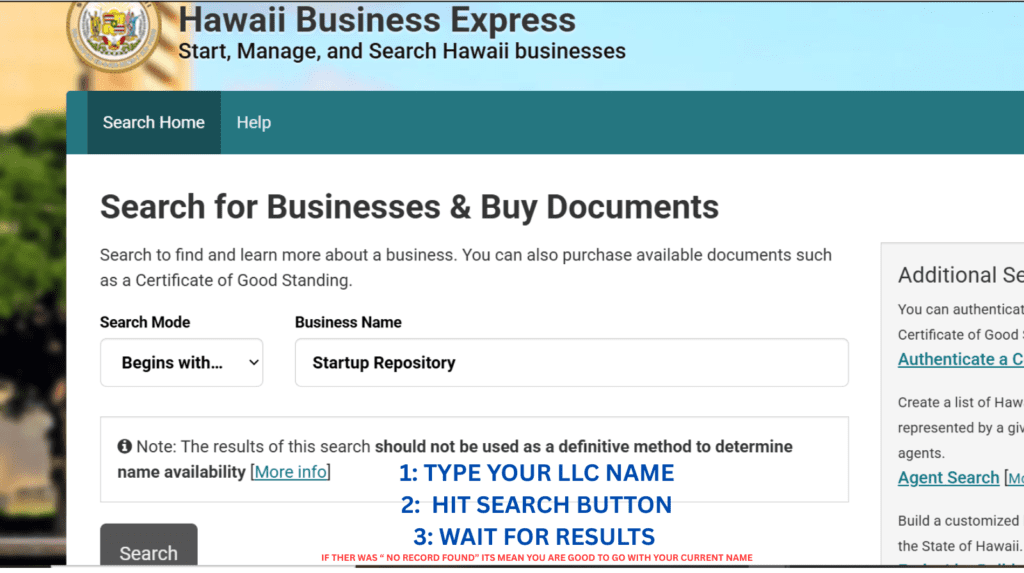

1. Choose and Verify Your Hawaii LLC Name

Start by selecting a unique name for your company. Use the Hawaii Business Express search tool (HBE) to check whether your desired name is available.

If the name is free, you can also reserve it for 120 days for a small fee, though reservation is optional.

2. Appoint a Registered Agent in Hawaii

Every LLC Hawaii is required to designate a registered agent with a physical street address in Hawaii (no P.O. boxes allowed).

Your registered agent will receive:

- Legal notifications

- State correspondence

- Compliance-related documents

You may act as your own registered agent if you live in Hawaii, or you may hire a professional service to handle mail and maintain privacy.

3. File the Articles of Organization

To officially create your Hawaii LLC, file the Articles of Organization (Form LLC-1) through the DCCA Business Registration Division.

Filing Fee:

- $50 (online or by mail)

Processing times are generally quick when using Hawaii Business Express.

You will need to provide:

- LLC’s legal name

- Registered agent’s name and Hawaii address

- Organizer information

- Management structure (member-managed or manager-managed)

4. Save Your Formation Documents

After your Hawaii LLC is approved, download and save your stamped Articles of Organization, payment receipt, and confirmation email.

These documents are necessary for banking, licensing, and future compliance tasks.

5. Obtain an EIN (Employer Identification Number)

Next, apply for an EIN through the IRS website. It’s free and issued immediately.

Your EIN will be required for:

- Opening a business bank account

- Hiring workers

- Filing federal taxes

6. Create an Operating Agreement (Recommended)

Although Hawaii does not require an Operating Agreement, having one is strongly recommended.

An Operating Agreement outlines:

- Member duties and ownership percentages

- Management structure

- Profit and loss allocation

- Procedures for adding/removing members

- Steps for dissolving the LLC

This document protects your company’s structure and helps avoid conflicts.

7. File Your Hawaii Annual Report

To keep your Hawaii LLC in good standing, you must file an Annual Report with the DCCA.

- Annual Report Fee: $12.50 (online)

- Due Date: End of the quarter in which your LLC was formed

- Example: If formed in March, your annual report is due by March 31 each year.

- Example: If formed in March, your annual report is due by March 31 each year.

Late filings can result in penalties and possible administrative dissolution.

Your business may also need local permits or state tax registrations depending on your industry.

Summary: Hawaii LLC Essentials

| Requirement / Step | Details |

| Name Availability | Check using Hawaii Business Express |

| Registered Agent | Must have a Hawaii physical address |

| Filing Fee | $50 (Articles of Organization) |

| Operating Agreement | Recommended, not required |

| EIN | Free from IRS |

| Hawaii Annual Report | $12.50 per year |

| Annual Report Deadline | Due every year in the quarter of formation |

Final Thoughts

Forming an LLC in Hawaii is simple, affordable, and ideal for entrepreneurs who want strong legal protection and flexible business structure. By maintaining your annual reports, choosing a reliable registered agent, and keeping your business records organized, your Hawaii LLC will stay compliant and ready for long-term success.

Whether you’re building a new company from scratch or expanding an existing one, a Hawaii LLC gives you liability protection, credibility, and a solid foundation to grow.