How to form LLC in Kansas

How to File an LLC in Kansas

Starting a Kansas LLC is a straightforward process using the Kansas Secretary of State’s online business filing system. Whether you live in Kansas or are forming a company from another state, creating an LLC in Kansas is affordable and efficient.

Below is a complete step-by-step guide explaining how to file an LLC in Kansas correctly.

Step-by-Step Guide: How to Start an LLC in Kansas

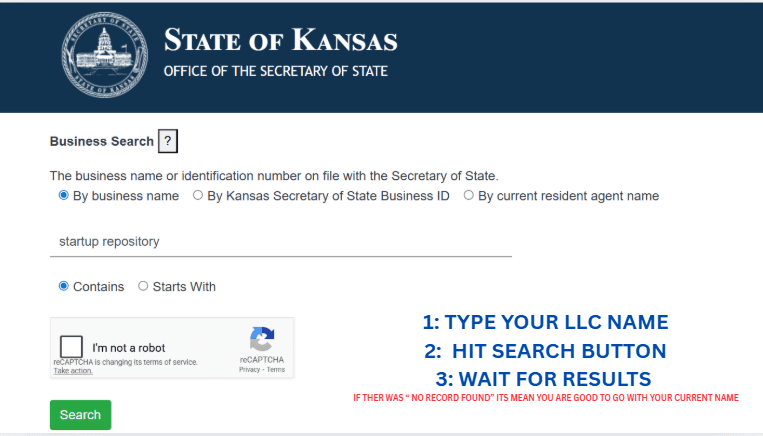

1. Choose and Check Your Kansas LLC Name

Begin by selecting a business name that complies with Kansas naming rules and is distinguishable from existing entities.

Use the Kansas Business Entity Search tool on the Secretary of State’s website to verify name availability.

Kansas also allows optional name reservations for 120 days if you want to secure your name before filing.

2. Appoint a Registered Agent in Kansas

Every Kansas LLC must designate a registered agent with a physical street address in Kansas (P.O. boxes are not allowed).

Your registered agent will receive:

- Legal documents

- Official state notices

- Compliance-related correspondence

You may serve as your own registered agent if you have a Kansas address, or you may hire a professional service for privacy and convenience.

3. File the Articles of Organization

To officially form your Kansas LLC, file the Articles of Organization with the Kansas Secretary of State.

Filing Fee:

- $165 online

- $160 by mail

Online filings are generally processed faster.

You’ll need to provide:

- LLC’s legal name

- Registered agent’s name and Kansas address

- Principal office address

- Management structure (member-managed or manager-managed)

4. Save Your Formation Documents

Once approved, download and store:

- Approved Articles of Organization

- Filing receipt

- State confirmation notice

These documents are important for banking, licensing, and proving your Kansas LLC’s legal existence.

5. Obtain an EIN (Employer Identification Number)

After forming your LLC, apply for an EIN from the IRS. The application is free and completed online.

An EIN is required for:

- Opening a business bank account

- Filing federal taxes

- Hiring employees

6. Prepare an Operating Agreement (Recommended)

Kansas does not require LLCs to file an Operating Agreement, but having one is strongly recommended.

Your Operating Agreement should define:

- Ownership percentages

- Member responsibilities

- Profit and loss allocation

- Management and voting rights

- Dissolution procedures

This document helps protect your limited liability status and keeps business operations organized.

7. File Kansas Annual Reports

To keep your Kansas LLC in good standing, you must file an Annual Report with the Secretary of State.

- Annual Report Fee: $50 (online) / $55 (mail)

- Due Date: 15th day of the 4th month after your tax year ends

- Most LLCs: April 15

- Most LLCs: April 15

Failure to file can result in late fees or administrative dissolution.

Depending on your business activities, additional local permits or state tax registrations may be required.

Summary: Kansas LLC Essentials

| Requirement / Step | Details |

| Name Availability | Check using Kansas Business Entity Search |

| Registered Agent | Must have a Kansas physical address |

| Formation Filing Fee | $165 online / $160 by mail |

| Operating Agreement | Recommended, not required |

| EIN | Free from IRS |

| Annual Report | Required yearly |

| Annual Report Fee | $50 online / $55 by mail |

| Annual Report Due Date | April 15 (most LLCs) |

Final Thoughts

Forming an LLC in Kansas is efficient and offers strong legal protection for business owners. By selecting a reliable registered agent, keeping your formation documents organized, obtaining an EIN, preparing an Operating Agreement, and filing annual reports on time, your Kansas LLC will stay compliant and positioned for growth.