How to File an LLC in Iowa

Starting an Iowa LLC is a straightforward process, thanks to the Iowa Secretary of State’s Fast Track Filing system. Whether you’re a resident or launching a business from another state, forming an LLC in Iowa is affordable and easy to manage.

Below is a complete step-by-step guide explaining how to file an LLC in Iowa correctly.

Step-by-Step Guide: How to Start an LLC in Iowa

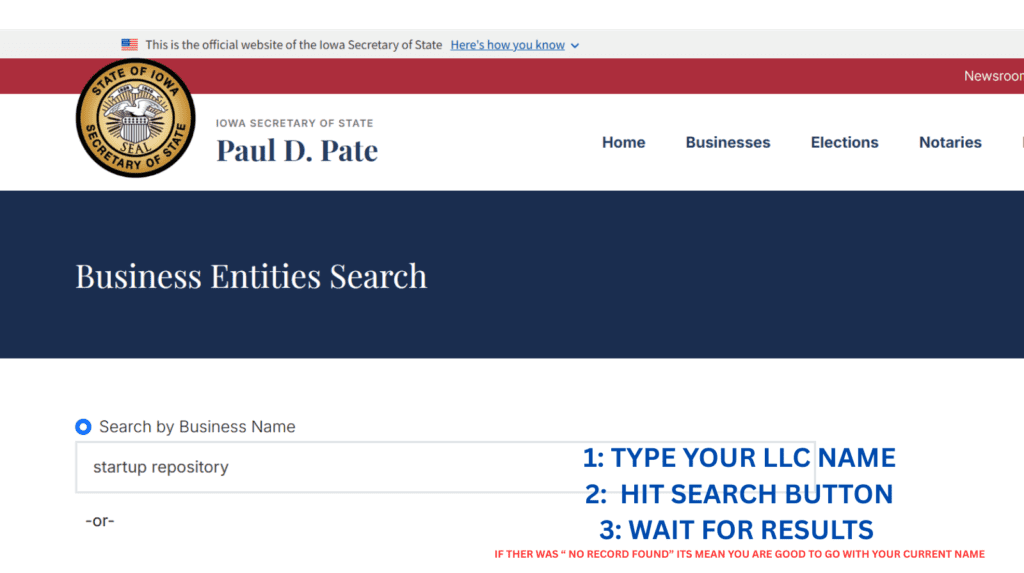

1. Choose and Check Your Iowa LLC Name

Begin by selecting a business name that meets Iowa naming requirements and is distinguishable from existing businesses.

Use the Iowa Business Name Search tool on the Secretary of State’s website to confirm availability.

Iowa also allows you to reserve a business name for 120 days if you’re not ready to file immediately.

2. Appoint a Registered Agent in Iowa

Every Iowa LLC must designate a registered agent with a physical street address in Iowa (P.O. boxes are not allowed).

Your registered agent will receive:

- Legal documents

- Official state correspondence

- Compliance notices

You may serve as your own registered agent if you have an Iowa address, or you can hire a professional registered-agent service for added privacy and convenience.

3. File the Certificate of Organization

To officially form your Iowa LLC, file the Certificate of Organization through the Iowa Secretary of State’s Fast Track Filing portal.

Filing Fee:

- $50 (online filing)

Online filings are typically processed quickly.

You’ll need to provide:

- LLC’s legal name

- Registered agent’s name and Iowa address

- Principal office address

- Management structure (member-managed or manager-managed)

4. Save Your Approved Documents

Once your filing is approved, download and securely store:

- Approved Certificate of Organization

- Filing receipt

- Confirmation email

These documents are important for banking, licensing, and verifying your Iowa LLC’s legal status.

5. Obtain an EIN (Employer Identification Number)

After forming your LLC, apply for an EIN from the IRS. The application is free and issued instantly online.

An EIN is required for:

- Opening a business bank account

- Filing federal tax returns

- Hiring employees

6. Create an Operating Agreement (Recommended)

Iowa does not require LLCs to file an Operating Agreement, but having one is strongly recommended.

Your Operating Agreement should outline:

- Ownership percentages and member responsibilities

- Voting and management rules

- Profit and loss distribution

- Procedures for adding or removing members

- Dissolution guidelines

This document helps protect your limited liability status and keeps internal operations organized.

7. File Iowa Biennial Reports

To keep your Iowa LLC in good standing, you must file a Biennial Report with the Secretary of State.

- Filing Fee: $60

- Due Date: Every two years by April 1 of odd-numbered years

Failure to file may result in late fees or administrative dissolution.

Depending on your business activities, you may also need local permits or state tax registrations.

Summary: Iowa LLC Essentials

| Requirement / Step | Details |

| Name Availability | Check using Iowa Business Name Search |

| Registered Agent | Must have an Iowa physical address |

| Formation Filing Fee | $50 (online) |

| Operating Agreement | Recommended, not required |

| EIN | Free from IRS |

| Biennial Report | Required every two years |

| Biennial Report Fee | $60 |

| Due Date | April 1 of odd-numbered years |

Final Thoughts

Forming an LLC in Iowa is affordable, efficient, and well-suited for entrepreneurs seeking liability protection and flexibility. By choosing a dependable registered agent, organizing your formation documents, securing an EIN, preparing an Operating Agreement, and filing biennial reports on time, your Iowa LLC will stay compliant and ready to grow.