How to file LLC in Florida

How to Create an LLC in Florida

Forming an LLC in Florida is a streamlined process, thanks to the online filing portal managed by the Florida Department of State. With reasonable fees and straightforward compliance obligations, setting up a Florida LLC is accessible whether you live in the state or operate remotely.

Below is a clear, easy-to-follow walkthrough for establishing your Florida Limited Liability Company (LLC).

Step-by-Step Guide: How to Form a Florida LLC

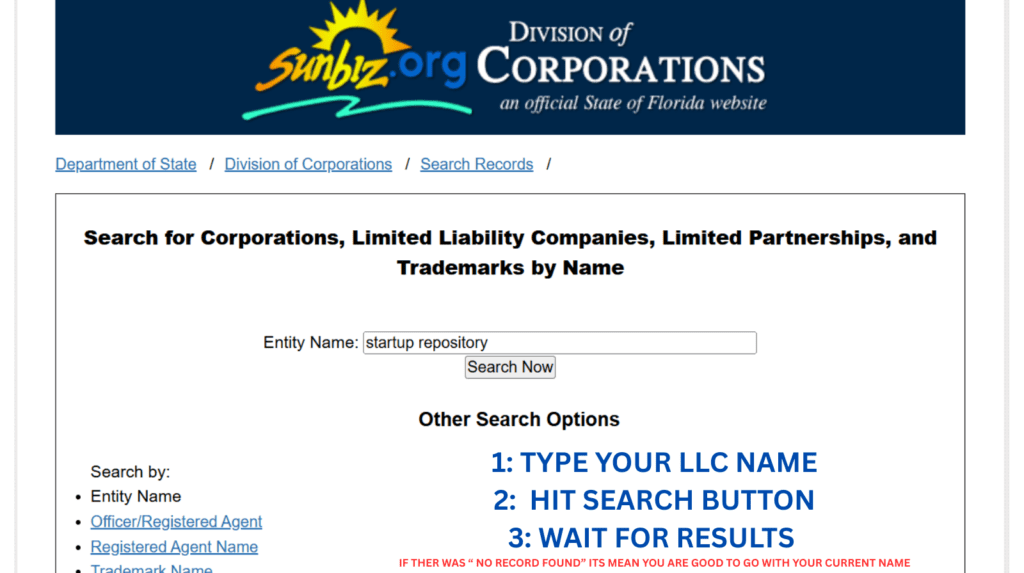

1. Choose and Check Your LLC Name

First, make sure your desired business name is unique and available. You can verify name availability using the Sunbiz database (the Florida Division of Corporations’ online record system).

Once you confirm availability, you may proceed with filing. Florida previously allowed name reservations, but current official guidance suggests being responsible for ensuring the name is unique.

2. Designate a Registered Agent in Florida

Every Florida LLC must name a registered agent who has a physical street address in the state (not a P.O. box).

This registered agent will receive official state correspondence and any legal or compliance notices on behalf of your business.

You can serve as your own agent (if you meet the address requirement), or use a professional registered-agent service — many entrepreneurs choose the latter for privacy and convenience.

3. File the Articles of Organization

To officially create your LLC, submit the Articles of Organization to the Florida Department of State via the Sunbiz online portal (or by mail).

Filing fee: typically $125. This covers the state filing fee ($100) plus the registered-agent designation fee ($25).

Once filed, Florida usually processes online submissions within a few business days.

4. Save Your Official Documents

After approval, download and securely store all registration documents, confirmation receipts, and official formation certificates.

Keeping these records is important for banking, tax registration, licensing, and compliance with state and federal regulations.

5. Obtain an EIN (Employer Identification Number)**

Once your LLC is established, apply for an EIN from the Internal Revenue Service (IRS). This federal tax ID is free to obtain online.

You will need the EIN to open a business bank account, hire employees (if any), and file federal tax returns.

6. Prepare an Operating Agreement (Strongly Recommended)

Although Florida doesn’t require you to file an Operating Agreement, having one is a smart best practice. A formal Operating Agreement outlines:

- Ownership shares and member contributions

- Voting rights and decision-making procedures

- Profit/loss distribution

- Rules for adding or removing members

- What happens if the LLC dissolves or changes management

This document helps clarify internal governance and protects your LLC’s liability status.

7. File Annual Reports & Meet Compliance Deadlines

To keep your Florida LLC in good standing, you must file an Annual Report after formation and then every year.

- Annual Report Fee: $138.75

- Filing Window: between January 1 and May 1 each year.

- If you miss May 1: a $400 late fee applies — total $538.75.

Failing to file may eventually lead to the LLC being administratively dissolved by the state.

Depending on your business location and activities, you may also need local business licenses, permits, or comply with local taxes.

Summary: Florida LLC Essentials

| Requirement / Step | What You Need / Fee / Timeline |

| Name availability | Verify on Sunbiz database |

| Registered Agent | Must have a Florida physical address |

| Articles of Organization filing fee | $125 (one-time) |

| Operating Agreement | Optional, but strongly recommended |

| EIN | Free from IRS |

| Annual Report fee | $138.75 per year |

| Annual Report due date | Between January 1 and May 1 |

| Late annual report penalty | $400 late fee if filed after May 1 (total $538.75) |

Final Thoughts

Setting up an LLC in Florida is a relatively straightforward and cost-effective process. With clear filing requirements, a reasonable formation fee, and an easy-to-use online registration portal, Florida is a favorable state for small business owners and entrepreneurs.

By properly choosing a registered agent, saving your documents, obtaining an EIN, drafting a solid Operating Agreement, and staying on top of your annual reports, you can keep your Florida LLC compliant and reap the benefits of limited liability, operational flexibility, and professional credibility.