How to file LLC in Colorado

How to Create an LLC in Colorado

If you’re wondering how to get an LLC in Colorado, the process is straightforward and can be completed online through the Colorado Secretary of State. The state filing fee for forming a Colorado LLC is $50, and there is a small annual/periodic report fee ( 25$ )to keep your LLC in good standing.

You can form your Colorado Limited Liability Company (LLC) by following the simple steps below.

Step-by-Step Guide: How to Get an LLC in Colorado

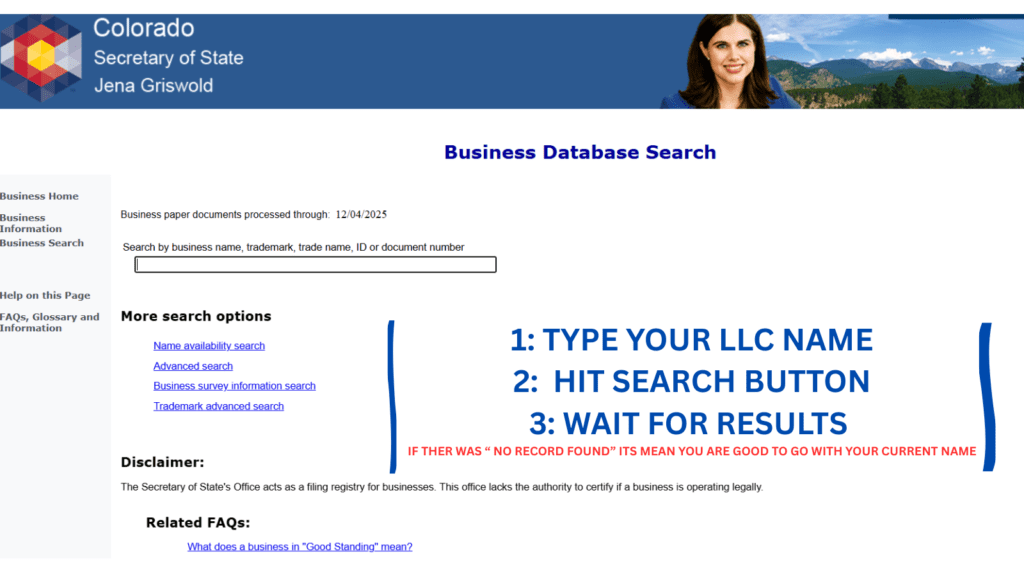

1. Check Name Availability

Before filing your LLC in Colorado, check whether your desired business name is available using the Secretary of State’s business name database on https://www.sos.state.co.us/biz/BusinessEntityCriteriaExt.do. Ensure the name isn’t already registered or too similar to an existing business.

2. Appoint a Registered Agent in Colorado

Every Colorado LLC must have a registered agent with a physical street address in Colorado (no P.O. boxes). The agent receives legal documents, state correspondence, and official notices on behalf of the LLC. You can act as your own registered agent (if you meet the address requirement), or hire a professional registered-agent service.

3. File the Articles of Organization

To officially create your LLC, file the Articles of Organization with the Colorado Secretary of State online via their business-filing portal. https://www.coloradosos.gov/business/filing/llc/intro?transTyp=ARTORG_LLC&entityType=DLLC&entityId

- Online filing fee: $50

- Provide required details: LLC name & address, registered agent’s name & address, organizer’s information, and structure (member-managed or manager-managed).

4. Save Your Filing Confirmation and Receipt

After filing, save the confirmation, payment receipt, and reference number. These documents act as proof of legal formation — useful for tax registration, opening a bank account, or business contracts.

5. Obtain an EIN (Employer Identification Number)

Once your LLC is approved, apply for an EIN through the Internal Revenue Service (IRS.gov). An EIN is needed to open a business bank account, hire employees, and file taxes. The application is free and you receive the number immediately.

6. Create an Operating Agreement (Recommended)

Although not legally required in Colorado, having an Operating Agreement is strongly recommended. It defines ownership structure, member roles, profit distribution, decision-making, and procedures for adding/removing members or dissolving the LLC. This helps protect limited liability and clarifies operations.

7. File Annual / Periodic Reports and Maintain Compliance

To keep your LLC active, you must file a Periodic Report each year with the Secretary of State.

- Fee: $25 annually.

- Due date window: The due date is based on your LLC’s formation anniversary — you can file within a window starting two months before and ending roughly two months after the anniversary month.

- Late filing penalties: If you miss the deadline, there may be penalties.

Also remember to comply with any federal requirements (e.g., beneficial-ownership reporting, taxes) and obtain relevant business licenses if required by your industry or locality.

Summary: Colorado LLC Requirements

Final Thoughts

Forming an LLC in Colorado is relatively simple and affordable compared with many states. By filing online through the Colorado Secretary of State, appointing a registered agent with a valid address, and committing to annual compliance (Periodic Reports, etc.), you can establish and maintain your LLC with ease.

Once formed and in good standing, your LLC gains the benefits of limited liability, flexible tax treatment, and a clear structure for growth — whether for a small business, consultancy, or larger venture.