How to Form an LLC in Arizona (2025 Guide) – Step-by-Step Registration & Cost Breakdown

Arizona offers online filing services for LLC formation. To form an LLC you must file the Certificate of Formation (Articles of Organization) with the Secretary of State. The filing fee is $50 and online filings are typically approved in 13-15 Business days. Expedite filing options are available for 35$ Extra. There are seven steps to form an LLC in Arizona.

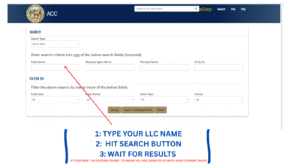

1. Check Name Availability (and Reserve if Needed)

Before you file, check whether your desired business name is available using the Arizona Secretary of State’s online business search tool. Simply go to https://ecorp.azcc.gov/EntitySearch/Index

Type your proposed name and research thoroughly to ensure it’s not already registered in the state — you cannot register a name that is already taken. If you are not ready to file immediately, you can reserve your business name for future filing. Name reservation rules also apply when expanding into another state: you may reserve the name in that state before you register there. Same if you have an LLC in a state and want to expand to other states you should reserve your name in those states you want to expand in future.

2. Appoint a Registered Agent

You must designate a registered agent who has a physical address in Arizona and can receive legal and state documents on behalf of your LLC. The registered agent can be you (if you are an Arizona resident), a trusted friend or family member, or a commercial registered agent service if you do not have a local contact.

3. Prepare and Submit the Articles of Organization

Use the Secretary of State’s online formation tools on

https://ecorp.azcc.gov/AzAccount

to complete the Articles of Organization (Certificate of Formation) create a user login Simply click on register provide your personal details and verify your email.

After successful account , simply login to your account and start the application. select your Business type as Limited Liability Company (LLC) Provide your business details, registered agent information, member or manager details (if required), and any additional attachments. Pay the $50 state filing fee and submit the form online following the site’s instructions.

4. Save Your Confirmation and Payment Receipt

When you submit your filing, save or print the confirmation page, reference/document/order number, and payment receipt. Keep these records in a secure folder (both digital and backup copies). If any issues arise, you will need the reference or document number to inquire about your filing status with the Secretary of State.

5. Obtain an EIN from the IRS

After your LLC is approved, ( Note: it’s recommended before you get your EIN you should wait for LLC approval from the state )apply for an Employer Identification Number (EIN) from the IRS at IRS.gov. Complete the online EIN application by answering questions about your business. The IRS typically issues the EIN immediately at the end of the online process; you will also receive a confirmation PDF.

6. Draft an Operating Agreement (Recommended)

Although not required to be filed with the Secretary of State, an operating agreement is an important internal document. It defines ownership percentages, member roles, management structure (member-managed vs. manager-managed), capital contributions, profit distribution, and procedures for adding or removing members or dissolving the LLC. Many banks, investors, and third parties expect an operating agreement.

7. File Required Federal and State Reports (BOI / FinCEN and State Filings)

Be aware of federal Beneficial Ownership Information (BOI) reporting under FinCEN and any state-level registration or tax requirements. FinCEN reporting rules and deadlines have changed recently, so check FinCEN guidance for current obligations. Also confirm Arizona state filing, annual report, and tax requirements with the Arizona Secretary of State and Department of Revenue.